Spikes Asia

Creating Asia’s Leading Digital Banking Experience

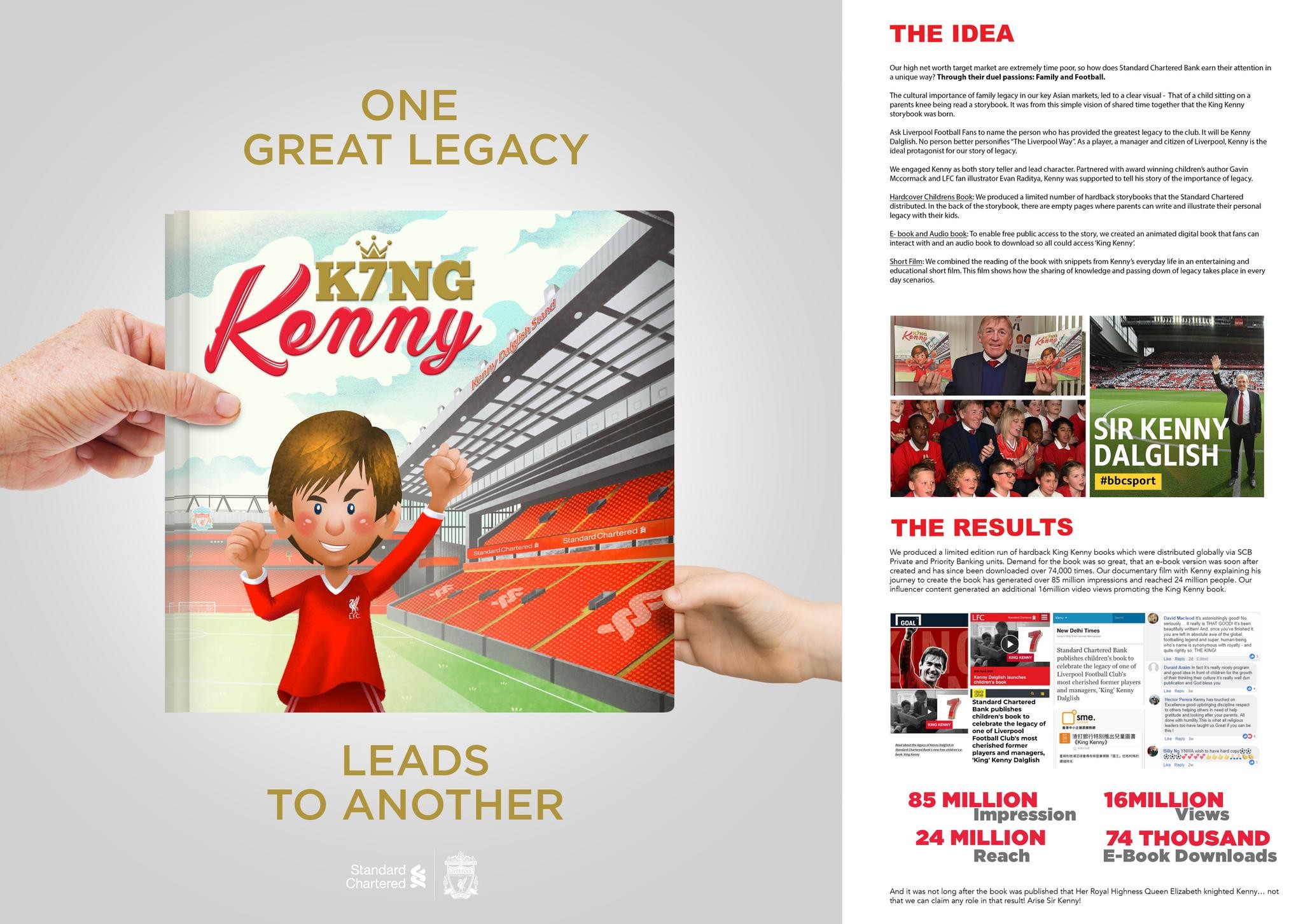

ANALOGFOLK, Hong Kong / STANDARD CHARTERED / 2022

Overview

Entries

Credits

OVERVIEW

Background

In 2019 the Hong Kong Monetary Authority issued virtual banking licenses to 8 recipients. Standard Chartered was one of them. Standard Chartered’s goal was to create a brand and banking experience with relevance to the under-served, including younger generations with evolving expectations.

Our team’s brief included:

> Creating a banking experience like no other – starting from the onboarding/account opening experience

> Acquiring a customer base of 150k in the first 12 months, with a focus on the younger generation

> Encourage active use of the account (spend)

> Encourage responsible borrowing

> Attract merchants to our reward program that are in line with customer lifestyle

> Through the experience we create, become the most trusted virtual bank in Hong Kong

Working with a small team of only 6 designers, we went about designing a new Hong Kong bank literally from our sofas.

Idea

The creative idea was born out of the brand’s mission to deliver a suite of innovative banking services and lifestyle benefits in one place to help grow your money, your world and your possibilities. The idea was to take a new, vibrant brand and experience to customers who we call ‘Generation Mox’.

At the heart of Generation Mox, are the underserved of society. A generation neglected by banks, who face great challenges to save and to improve their financial status short and long term. So rather than designing a typical banking experience, we created a lifestyle-based experience that was more relevant and appealing to them, with banking services at its heart.

Generation Mox are not just an age group or gender - they are a mindset. They are looking for a bank that is friendly to use, actively helps with money management and gives back to them in real time.

Execution

Mox was designed to emotionally and consistently connect with proud Hong Kongers. To give our banking experience a distinctly Hong Kong flavour, our colours were inspired by the city’s vibrant neon lights. The City’s energy was reflected in the introduction of motion graphics, animation, and a new illustrative style to add more dynamic appeal to the audience. As part of the process, we established new principles for motion to be applied across Mox’s online banking experience, crafting micro-moments that would help delight customers.

We introduced design patterns common to experiences our audience were familiar with, such as stories from social experiences, and repurposed them for activation of different features as well as promotions.

With a truly unique numberless card that was both a debit and a credit card, we designed a simple way to toggle from one mode to the other. And to help customers save, we created savings ‘buckets’.

Outcome

1. In one year we’ve acquired 170k+ customers

2. 80% onboarded (opened account) in as little as 3 minutes

3. Data shows skew to 18 - 34-year-olds (primary target)

4. Since launch: more than HKD2.3bn in spend, with most active customers using the bank daily

5. HKD5B of savings have been deposited into Mox, with customers setting goals to save for family holidays, marriages, childbirths, taxes, and even funerals

6. HKD4bn has been loaned to Mox customers since launch

7. Recently, Mox has been voted as the most trusted virtual bank in Hong Kong by YouGov

8. Our app is rated 4.8 out of 5 on App Store and 4.6 on Play Store, making Mox the highest-rated virtual bank here in HK.

9. Ranked in the top 20 in the world by SIA, No.1 in Hong Kong and No.1 in Asia.

10. 80+ merchants now aboard in rewards program

Similar Campaigns

12 items