Spikes Asia

The Algorithm Agent

TBWA\HONG KONG / STANDARD CHARTERED / 2019

Overview

Entries

Credits

Overview

Background

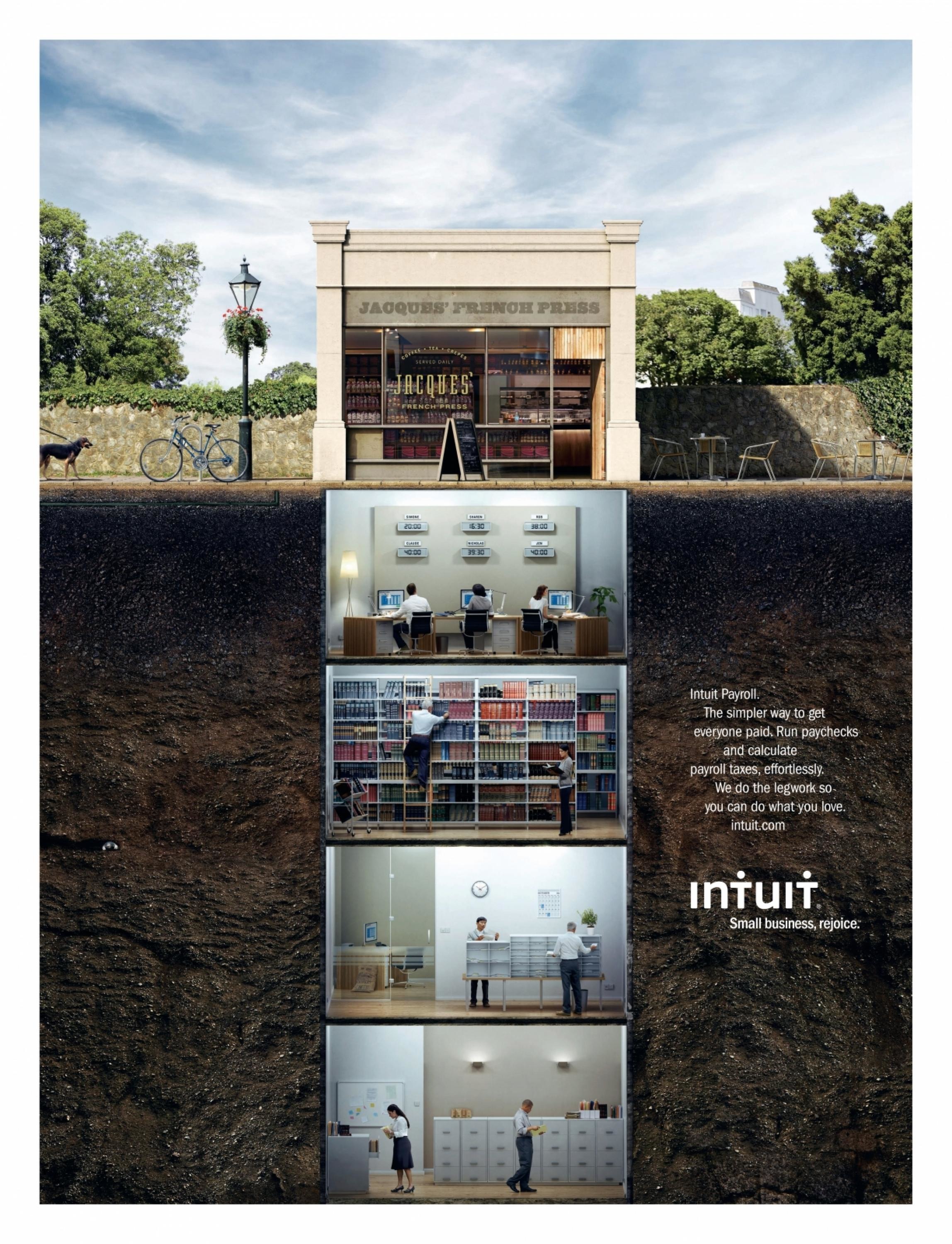

WALLETS WERE GETTING FULL

Over 20 million credit cards are circulating in Hong Kong - that’s an average of four cards for every adult. Such severe market saturation has stemmed market growth. By 2018, net acquisition of new cards slowed to 1.1%, a sixth of what it was in 2011.

FIGHT AMONGST BANKS WAS GETTING UGLY

As an outcome, banks use desperate tactics to win the next cardholder, such as using aggressive sales agents to intercept unsuspecting pedestrians at random.

OUR PRODUCT WAS OUTCOMPETED FROM THE GET-GO

Every bank was jumping on the cashback bandwagon. Competitors were offering four times more cashback compared to the 1.5% that Simply Cash Visa Card offered. We needed a radically different approach to acquire millennial cardholders. One that was more effective and sustainable.

BUSINESS OBJECTIVES:

- Increase credit card sign-ups by 30%.

- Reduce Cost-Per-Acquisition by 10%.

(KPIs set by previous campaign benchmarks)

Idea

Product insight: Less is more if it’s unconditional.

Scrutiny into hundreds of terms behind common cashback offers revealed a maze of complex rules. Our card’s saving grace was that its cashback came without caveats. The proposition was ‘limitless cashback for limitless joy’.

Data insight: One segment, 1,267 lifestyle interests.

Millennials are thought to be into more or less the same things. Analysis of search, social and platform data revealed a long-tail of 1,267 spending-related interests that were searched 3 billion times each month.

Channel insight: One magazine for every lifestyle is YouTube.

Amongst our target audience, 4 in 5 use YouTube every week. They habitually window-shop and learn via trending content on the platform.

IDEA: LIMITLESS TRENDING CONTENT CAN BE TURNED INTO ‘AGENTS’ TO SELL A LIMITLESS CASHBACK CARD.

The ‘Algorithm Agent’ was a data-fuelled automated acquisition engine that captured customers using real-time customised content.

Strategy

Our target audience were ‘young urbanites’ aged 22 to 35. They have an average credit card spending of US$730 each month across a diverging set of lifestyle interests. 83% of these millennial shoppers turn to YouTube for reviews and product information before making purchase decisions.

This segment believes they are overlooked by most traditional banks. Mileage-based credit cards fail to impress as they feel it takes too long to earn enough miles for a free flight. In contrast, cashback is favoured for its simplicity and versatility.

With our product only having one clear competitive advantage – that it had no spending caveats – our strategy was to highlight its endless cashback-earning opportunities using the endless pieces of spending-related content available on YouTube.

And beyond performing a mere demonstration, we designed a full-funnel marketing system that captured millennials as they were being enticed with such trending content.

Execution

TARGET

This stage is about spotting audiences. Google implemented data-targeting by finding users as they were looking for content related to our interests.

HOOK

This stage is about ‘seducing’ audiences. When Director Mix spots a right audience, it ‘mixes’ a pre-roll ad based on the content sought after. Over 16M+ customised flock videos were generated. E.g. if a “10-minute make-up tutorial” was desired, it served this 6-second ad: “In a rush for a blush? Earn 1.5% cashback on that.”

CLASSIFY

Those who were served customised ads were retargeted with a 15-second tactical ad. As this was a skippable TrueView video, the pool of those who did not skip was classified as having product intent.

CONVERT

This pool was then converted through a programmatic approach. It drove traffic to the online sign-up form using offer-based display, search and re-marketing tactics.

Outcome

REACH & EFFICIENCY

(KPIs set by Hong Kong finance category benchmarks)

YouTube Pre-Roll Flock Ads (6sec)

•KPI Goal: Reach 2M @ US$5.49 CPM

•Result: Reached 2.6M @ US$4.85 CPM

•Reached 86% of target universe on YouTube

YouTube TrueView Ads (15sec)

•KPI Goal: CPV No higher than US$0.038

•Result: CPV US$0.023 (40% lower than KPI)

•Viewability Rate: 94%

CONSIDERATION

(KPIs set by previous campaign benchmarks)

•KPI Goal: Improve product consideration by 25%.

•Result: 40% lift during campaign period.

•KPI Goal: Increase brand and product search by 20%.

•Result: 156% lift during campaign period, more than 7 times higher than KPI.

BUSINESS OBJECTIVES - CONVERSION

(KPIs set by previous campaign benchmarks)

•KPI Goal: Increase credit card sign-ups by 30%.

•Result: 62% lift within 4 weeks, more than double the KPI.

•KPI Goal: Reduce Cost Per Acquisition by 10%.

•Result: CPA dropped 23% vs previous campaigns, more than double the KPI.

Similar Campaigns

11 items