Integrated > Integrated

DUOVERSE

SAATCHI & SAATCHI, Hong Kong / HSBC / 2024

Overview

Credits

Overview

Why is this work relevant for Integrated?

HSBC’s DuoVerse campaign leveraged above-the-line, social, influencer, mobile experience and a live concert experience to deliver long-term mobile app adoption.

Every touchpoint throughout the campaigns user journey was designed to be fun, educational, and drive actual usage towards HSBC’s mobile app. Even the concert itself drove app education and usage during the event. The strategic use of these integrated touchpoints for the 18-34 audience successfully lead to HSBC becoming the #1 mobile app with the key demographic.

Background

Virtual banks in Hong Kong have dominated the mobile banking space, with 1.5 million accounts opened in 2022, primarily by GenZ and Millennials.

HSBC on the other hand was perceived as “mature”, “conservative” and not innovative with the younger segments, despite its mobile banking capabilities. Over 60% of HSBC’s customers were above 40+, and it needed to position itself as innovative and relevant to younger audiences or else lose them forever. Despite being Hong Kong’s largest bank, only 26% of GenZ used HSBC’s mobile app, compared to 41% for the leading virtual bank.

The objective of the campaign was clear:

1.Change the perception of HSBC and reinforce its positioning as a leading digital bank among GenZ and younger Millennials (18-35)

2.Acquire new, younger HSBC customers

3.Drive adoption of the HSBC mobile app among non-users

4.Drive uplift and increase active usage of the HSBC mobile app among existing users

Please provide any cultural context that would help the jury understand any cultural, national or regional nuances applicable to this work e.g. local legislation, cultural norms, a national holiday or religious festival that may have a particular meaning.

In 2020, 8 virtual banks launched and quickly began to drive customer share, particularly in the mobile banking space. The behaviour to switch from traditional banking to digital and mobile banking was exacerbated during the pandemic, with more people looking to go cashless.

While the pandemic supercharged this behaviour, it didn’t go away when the pandemic did. By 2023, 66% of Millennial and GenZ consumers were willing to switch to pure play virtual banks due to their strength in innovation and mobile experience.

HSBC on the other hand is one of the worlds oldest banks, and Hong Kong’s largest. It was seen as “the bank my parents use”, and therefore perceived as “uncool” among younger consumers.

Describe the creative idea

In order to transform brand perception, HSBC couldn’t just play catchup; it had to move into the lead. We couldn’t just be perceived as innovative, we needed to be perceived as the most innovative. Our campaign would need to communicate to customers that HSBC’s prowess in mobile banking was as strong as its strength in traditional banking.

Which brought us to our idea:

DuoVerse - The Best of Both Worlds

We would showcase digital superiority by creating never before seen digital experiences to our customers, while educating them on our features throughout the user journey.

Describe the strategy

The truth is, while our younger audience enjoy mobile banking, they don’t want to talk about banking. For them, experience is everything, and virtual banks provide them an experience that is innovative and fun.

To capture the 18-34 demographic and drive mobile adoption, we could not use typical bank speak.

Our approach was to leverage 2 key trends to provide them a market-leading innovative experience.

1.Concerts. Live entertainment skyrocketed once pandemic restrictions were lifted, with high demand for concert tickets particularly with young audiences.

2.The metaverse. Interest in the metaverse rose rapidly from 2020 to 2022. Despite this interest, many have never actually experienced the metaverse.

HSBC had the opportunity to leverage these trends and truly engage with our younger audience, by turning pop-culture into money culture. Every step of the campaign would feature fun and innovation, educating audiences on our digital prowess while culminating in a once-in-a-lifetime innovative experience.

Describe the execution

HSBC announced it would hold the first-ever DuoVerse, a concert performed in physical and virtual worlds simultaneously, while for the first time ever bringing together two major Hong Kong pop-stars Tyson Yoshi and Serrini.

To drive mobile adoption, our launch film and OOH announced that in order to win tickets, you had to use our mobile app. The more you used it and the more features you used, the higher chance to win.

4 months of social and influencer content was developed to engage audiences while educating them on the enhanced apps features leading up to the show.

This culminated in DuoVerse: a live concert experience in both offline and virtual worlds. Motion capture technology allowed Tyson and Serrini’s avatars mirror their real-world movements, while live concert goers can view the metavere via on-stage broadcast. Throughout the concert, fans could win prizes by completing challenges about the apps capabilities.

List the results

Over 100,000 people registered for the campaign within the first week

12,000+ people attended the concert online and within the metaverse

Among 18-34, HSBC mobile bank adoption jumped to 47% from 26%, becoming the #1 mobile bank among younger consumers in Hong Kong

Overall user growth during the campaign period was 2x higher than the same period a year prior

Brand perception among 18-34 that HSBC is the “Top Mobile App” increased by 17%

By the end of the campaign, HSBC had over 2 million monthly active users, the highest point ever, representing ⅓ of the adult population

More Entries from SAATCHI & SAATCHI

24 items

Sweet Foods & Snacks

REPLACEMENT

GENERAL MILLS, SAATCHI & SAATCHI

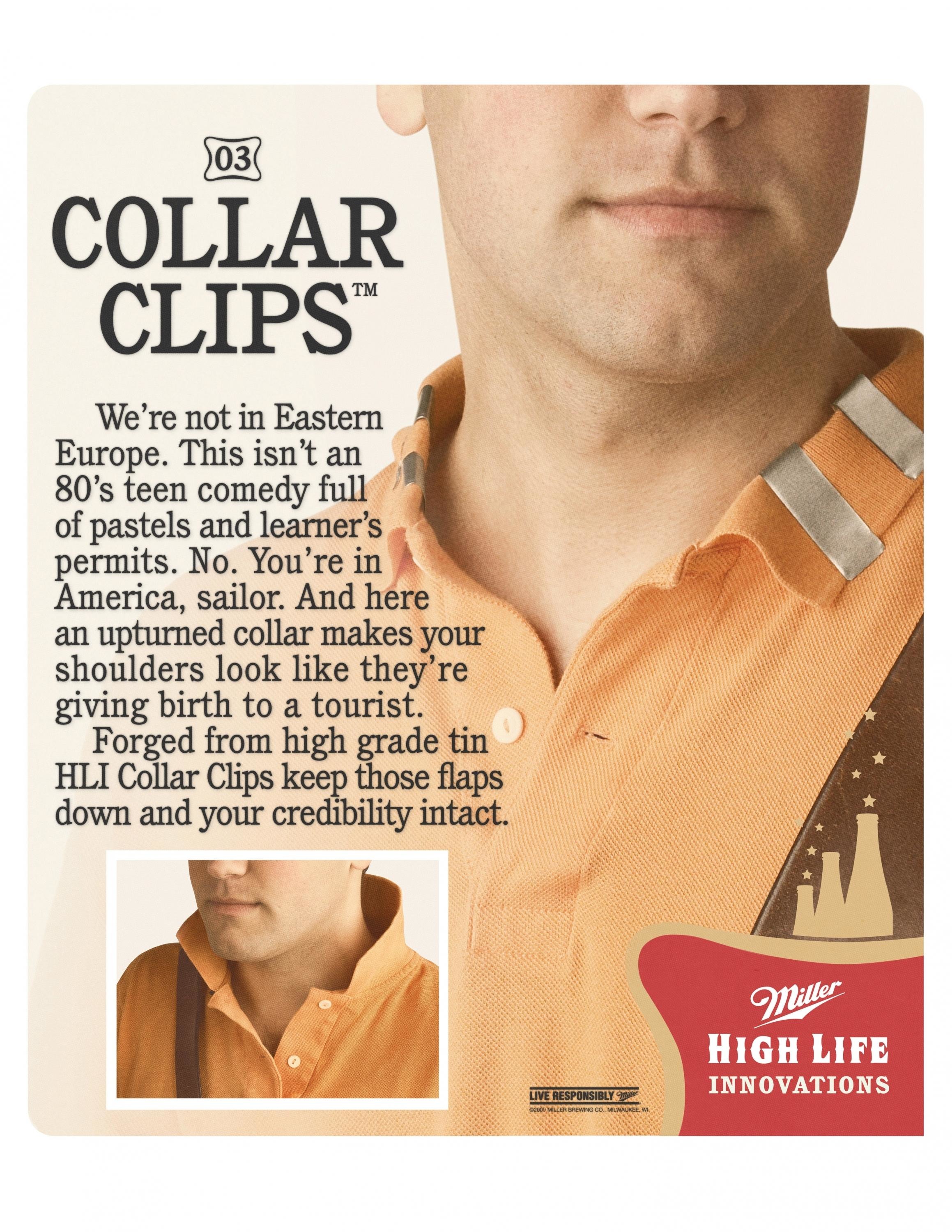

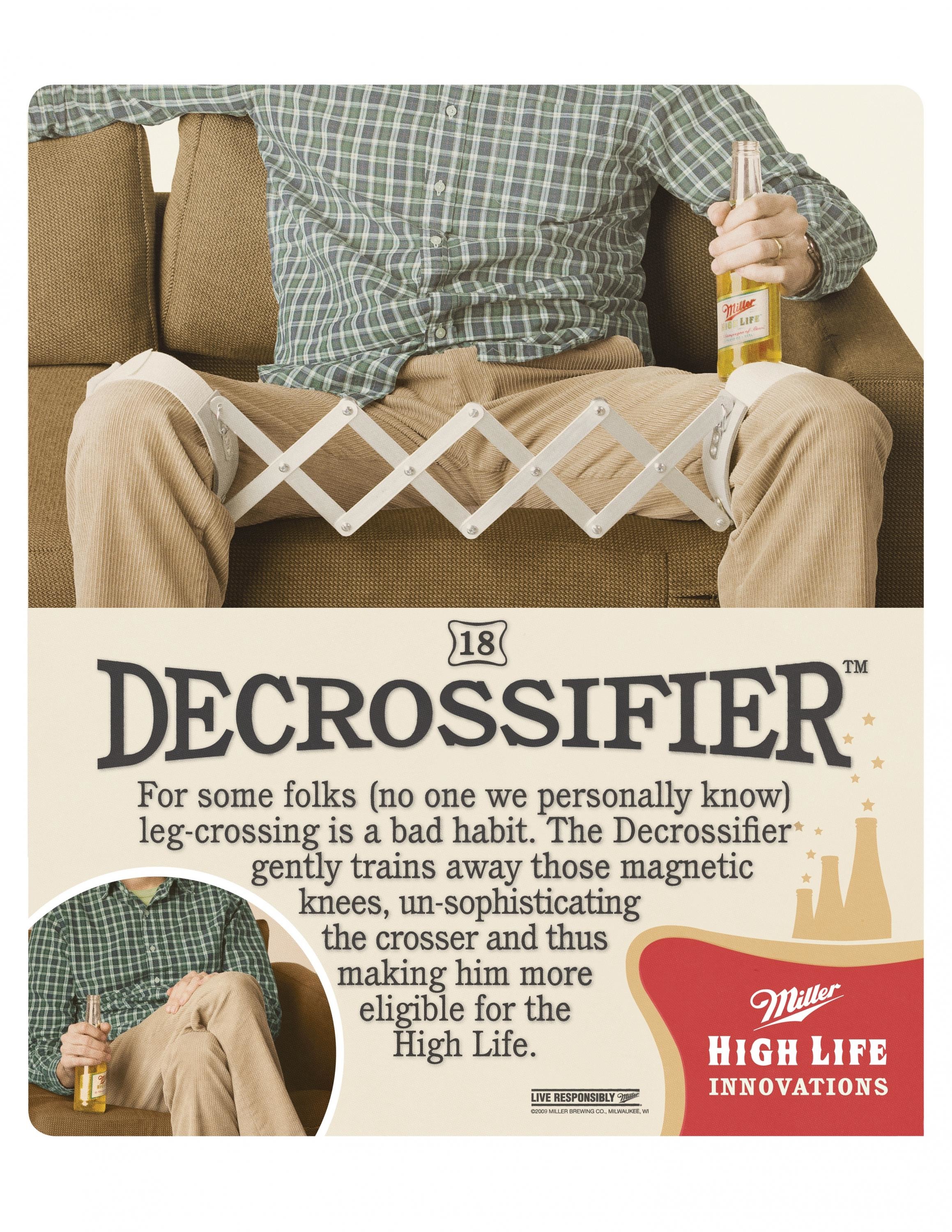

Alcoholic Drinks

PINKY RESTRAINT

MILLER BRANDS, SAATCHI & SAATCHI