Creative Business Transformation > Business Design & Operations

DATA TIENDA

DDB MEXICO, Mexico City / GAHR WECAPITAL / 2023

Awards:

Overview

Credits

Overview

Background

Millions of low-income women in Mexico cannot study or start a business because they do not have access to bank credit.

According to the National Banking and Securities Commission, 83% of them don’t have a bank payment history that allows for verification of their payment behavior, thus having their loan applications rejected.

Brief:

WeCapital, seeking the financial inclusion of low-income women in Mexico, asked us to find a way to help millions of them gain easier access to microcredits.

Goals:

• Financial inclusion of over 83% of Mexican women.

•Rebuild the credit histories of more than 35 million low-income women.

•Increase the visibility of gender equality in Mexico.

•Strive for economic autonomy and empowerment for thousands of women in one of the 20 countries that are among the worst countries for women according to the UN (United Nations).

•Support the task of bankarization of the financial sector and government.

Strategy & Process

Millions of low-income women in Mexico are unable to become entrepreneurs because they do not have access to bank credit. According to the National Banking and Securities Commission, 83% have no “credit history,” so their loan applications are rejected.

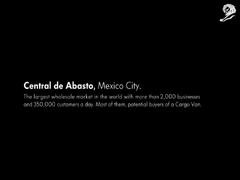

The irony is that the vast majority of women in Mexico and Latin America ensure the survival of their families with loans in small neighborhood stores. They received loans things almost daily for their family’s livelihood and commit to paying them on time and at the end of the week, fortnight, or month, so they have a long credit history.

Our strategy is to restore this credit history so that more than 35 million women, previously invisible to the banking sector, can achieve financial inclusion and economic independence.

Experience & Implementation

01/2021 - 12/2021:

• Development and testing to enable proper automation of data.

• The first 1,000 records are collected on the platform, and the first credit histories are recovered with them.

01/2022 - 12/2022:

• datatienda.mx recovers more than 10,300 credit histories the data of more than 50 thousand businesses from all parts of the country.

• The communication campaign was launched in major cities (March).

• 23% of women on the platform (more than 2,300 women) receive microcredits for their businesses ranging from $2,000 to $20,000 Mexican pesos.

• Sessions were initiated with financial institutions in Colombia, Guatemala and Venezuela.

01/2023 - Today:

• datatienda.mx recovers more than 30,100 credit histories the data of more than 140 thousand businesses from all parts of the country.

• 37% of women on the platform (more than 7,400 women) receive microcredits for their businesses ranging from $2,000 to $20,000 Mexican pesos.

Business Results & Impact

•Since the platforms launch, more than 20,100 women have registered to build their credit history.

•Of the more than 20,100 women who have registered on the platform, 37% (more than 7,400 women) have received microloans for their businesses and study plans.

•With Data Tienda, we were able to obtain data from more than 140,000 business owners across the country to financially include thousands of low-income women.

•We restored the economic autonomy and empowerment of thousands of women.

•We have made visible gender inequality in Mexico.

•We have promoted entrepreneurship and job creation in the country.

•We have supported the efforts of the financial sector and the government to make the country’s banking sector more bankable.

•We have reduced the financial sector’s risk margin in popular sectors.

Is there any cultural context that would help the jury understand how this work was perceived by people in the country where it ran?

Mexico is one of the 20 worst countries for women according to Forbes. High rates of violence, poverty, and gender inequality make the country an increasingly hostile place for women.

According to El Economista, more than 24 million Mexican women live in poverty, and as if that were not enough, they cannot study or start a business because they do not have access to bank loans. According to Forbes, 83% of them have no credit history, so their loan applications are rejected.

Data tienda collects information about unbanked women by analyzing their payment behavior in a small neighborhood business. In this way, it opens up the possibility for more than 35 million women who are invisible to the financial system to have a credit history and thus access bank loans that enable them to become entrepreneurs and achieve financial inclusion, economic autonomy, and empowerment.

More Entries from Brand Purpose & Impact in Creative Business Transformation

24 items

More Entries from DDB MEXICO

24 items