Creative Business Transformation > Customer Experience

MASTERCARD: THREE YEARS OF INCLUSIVE CARDS

McCANN, New York / MASTERCARD / 2023

Awards:

Overview

Credits

Overview

Background

The creative work you are about to see changed the fundamental way that Mastercard positions its business.

Over the past three years, Mastercard created three new products that became a key selling point for new business pitches with banks and retailers. They became a core part of what differentiates Mastercard from its competitors. And most importantly, they became revenue generators for the company at large.

In the words of Luke Sullivan, these were not “advertising ideas.” These were “ideas worth advertising.”

Strategy & Process

As a brand built on creating priceless experiences, Mastercard wanted to do something priceless for financially marginalized people.

We identified three audiences that needed our help: the transgender community, partially-sighted people, and those living with dementia.

What would be the most priceless thing Mastercard could do for these three groups?

For the transgender community the opportunity was obvious. Allow them to dictate their own names. True Name was the first credit card that allowed people to use their chosen names.

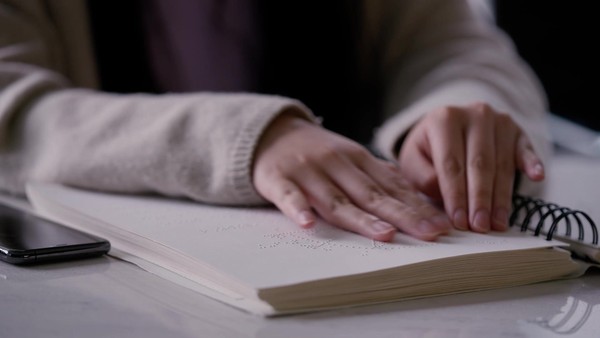

For the partially-sighted, it was more subtle. We had to change the card itself. Touch Card used a system of notches to allow anyone to tell their cards apart with a touch.

For those living with dementia, the challenge was the greatest. We introduced Sibstar, an app and card that allow caregivers to put guardrails on their loved ones’ spending.

Mastercard’s biggest challenge is a fundamental lack of differentiation in its product. Mastercard, Visa, Amex, and Discover all offer the same speed, security, and convenience.

To solve for this, we needed to lean into our brand, and bring our priceless platform to life with real action. One area where Mastercard could make a difference that was truly priceless: financial inclusion.

We did quantitative and qualitative research and connected with the communities we were trying to help. We worked with LGBTQIA+ advocacy organization GLAAD, The Royal National Institute of Blind People, VISIONS/Services for the Blind and Visually Impaired, and the Alzheimer’s Society.

Through this we learned that the cards we use every day have basic design flaws.

They force transgender and non-binary people to use their birth names against their will.

They are impossible for partially-sighted people to distinguish by touch.

They are too complex for people with dementia.

Experience & Implementation

With this in mind, we shifted our focus to redesigning the most basic gateway to financial inclusion: cards themselves.

But there was one catch. Mastercard doesn’t issue cards — banks do. Mastercard makes cards work, but banks own the cards themselves.

Rather than viewing this as an obstacle, we saw it as an opportunity to deepen our relationship with banks and other card-issuers by working together and sharing the credit.

Over the course of three years, we partnered with dozens of banks and issuers to create billions of cards.

True Name (launched 2020): now available to 900 million people in 32 countries

Touch Card (launched 2021): now available to 200 million people in 10 countries

Sibstar (launched 2023): now available to 67 million people in the UK, with more countries coming

Business Results & Impact

Printing this many cards was no small effort.

What was the result?

From a business perspective, these three products have fundamentally changed the way Mastercard pitches new clients. Over the last three years, Mastercard has won hundreds of deals with these products as selling points.

But the biggest impact we’ve had is on Mastercard’s brand. Consider Chase bank — one of the largest banks in the world. Their cardholders now see Mastercard differently than Visa:

Socially-Conscious: +14 pts vs Visa

Innovative: +16 pts vs Visa

Customer-Centric: +27 pts vs Visa

Visionary: +45 pts vs Visa

We didn’t just accomplish reach and revenue. We achieved profound changes in the way people view Mastercard.

That is priceless.

Is there any cultural context that would help the jury understand how this work was perceived by people in the country where it ran?

1.4 billion people on Earth are “unbanked,” and do not have access to the modern banking system. This limits what they can do enormously — cash is less secure, less flexible, and only allows for gray market loans to start small businesses.

Over the course of three years, Mastercard created a suite of three products and services that made financial inclusion a reality for millions of people around the world.

More Entries from Targeting, Insights & Personalisation in Creative Business Transformation

24 items

More Entries from McCANN

24 items